- Payroll Administration Basics

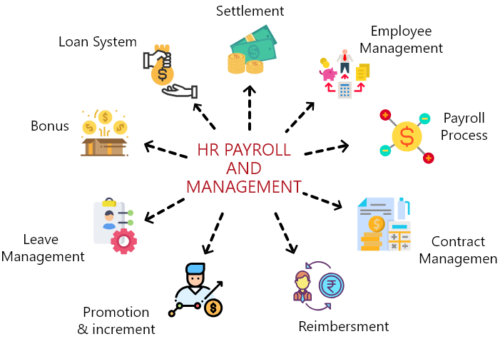

- Definition of payroll and its importance in organizational operations.

- Overview of payroll cycles and timelines (e.g., weekly, bi-weekly, monthly).

- Roles and responsibilities of HR in payroll management.

- Payroll Processing Steps

- Employee data collection and maintenance.

- Calculation of gross wages, deductions, and net pay.

- Handling overtime, bonuses, and commissions.

- Compliance with tax regulations and deductions.

- Legal and Compliance Aspects

- Understanding labor laws and regulations related to payroll.

- Compliance with wage and hour laws, including overtime rules.

- Tax filing requirements and payroll reporting obligations.

- Payroll Systems and Technology

- Importance of payroll software and automated systems.

- Benefits of integrating payroll with HR and accounting systems.

- Security measures for protecting payroll data and employee privacy.

- Employee Communication and Transparency

- Providing clear pay statements and explanations.

- Addressing payroll inquiries and resolving discrepancies.

- Ensuring transparency in payroll processes and policies.

- Payroll Audits and Risk Management

- Conducting periodic payroll audits for accuracy and compliance.

- Identifying and mitigating payroll risks, such as fraud or errors.

- Implementing controls to safeguard payroll operations.

- Emerging Trends in Payroll Management

- Adoption of cloud-based payroll solutions.

- Impact of remote work on payroll processes.

- Trends in payroll analytics and reporting for strategic decision-making.

These key points provide a foundational understanding of HR payroll, covering essential concepts and practices necessary for effective management in organizations.

“Discover your HR potential at Next Innovation Asia, Chennai’s premier HR Training Institute. Gain certified training, essential skills, and career support. Join us today for a brighter future in HR!”